Documenting Harassment: Building a Case Against Unethical Collectors

- Shaksha

- Jul 9, 2025

- 6 min read

Have you ever been bombarded with incessant calls, threatening messages, or unfair demands from debt collectors? It’s an unfortunate situation many people find themselves in. When creditors or collectors cross the line and engage in harassment, it’s essential to know that you have legal recourse. But before you can take action, the key is proper documentation. In this blog, we’ll explore how documenting harassment from debt collectors can help you build a solid case and protect your rights.

Why Is Documenting Harassment So Important?

When dealing with unethical debt collectors, the importance of documentation cannot be overstated. Why? Because it serves as evidence that can protect your rights and help you take legal action. The law can be on your side, but only if you have the proof to back it up.

Documenting harassment involves keeping records of every interaction you have with debt collectors.

This includes phone calls, text messages, emails, letters, or in-person meetings. In cases of harassment, the evidence you gather can strengthen your case and help you navigate through legal proceedings effectively.

Types of Harassment You Need to Document

Debt collectors are prohibited from using aggressive tactics to collect debts. The Fair Debt Collection Practices Act (FDCPA) lays out clear guidelines for how collectors can behave. If they violate these rules, you have a right to challenge their actions. Here are some types of harassment that you should document:

Repeated Calls and Unreasonable Hours:

If you’re receiving calls at inconvenient times (early morning, late at night) or excessive calls in a single day, you need to note these incidents. The FDCPA restricts the frequency of calls.

Threatening Behavior:

Debt collectors cannot threaten you with physical harm or imprisonment. If they use such threats, document every instance, including the language used.

Misleading Statements:

Collectors are forbidden from lying about your debt, their authority, or the consequences of non-payment. Document any false statements, especially if they threaten you with things like arrest or legal action that aren’t possible.

Contacting Third Parties:

Debt collectors cannot discuss your debt with family members, friends, or employers unless you explicitly consent. If they violate your privacy, record the details and keep copies of any letters or messages they send to third parties.

Abusive Language:

Any form of abusive language or derogatory comments from debt collectors should be documented. Harassment is not just about threats, it’s also about treating you with disrespect.

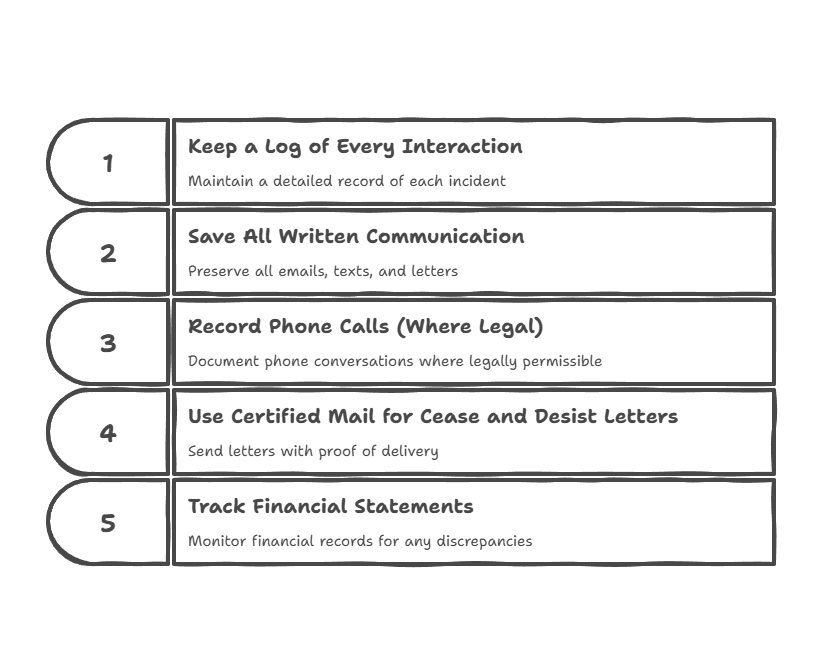

Steps to Documenting Harassment Effectively

When facing harassment, knowing how to document it is crucial. Here’s a step-by-step guide to help you keep a detailed record:

Step 1: Keep a Log of Every Interaction

Start by maintaining a log of every contact you have with the debt collector. For each interaction, note the following:

Date and Time: Record when the contact occurred, as debt collectors are restricted to contacting you only during certain hours.

Method of Contact: Was it a phone call, text message, email, or physical letter?

Content of the Conversation: Summarize what was discussed. If they made threats or used aggressive language, write down exactly what was said.

Name of the Collector: Note the name and company of the debt collector. If you speak to more than one person, keep track of who you’re speaking to each time.

Step 2: Save All Written Communication

Whether it’s emails, letters, or messages, save every piece of communication from the collector. Make sure to keep:

Email Correspondence: Print out or save screenshots of any emails you receive.

Letters: Keep the original letters and take photos of any handwritten communications, especially those that make threats or false statements.

Text Messages: Take screenshots of text messages that contain threats, lies, or harassment.

Step 3: Record Phone Calls (Where Legal)

In some jurisdictions, it’s legal to record phone conversations as long as one party (you) consents. In others, both parties need to consent. Before recording, verify whether it's allowed in your location. If it’s legal, recording conversations can provide solid evidence of harassment.

Step 4: Use Certified Mail for Cease and Desist Letters

If you decide to send a cease and desist letter asking them to stop contacting you, do so via certified mail. This provides proof that the collector received the letter, which can be crucial if you need to take further legal action. Keep a copy of the letter for your records.

Step 5: Track Financial Statements

Keep records of your financial statements to show whether you’ve made any payments or whether the debt collector is misrepresenting the status of the debt. If payments are being made or the debt is not as high as they claim, these documents can act as evidence against the collector.

What to Do With Your Documentation

Once you’ve gathered sufficient evidence, the next step is to decide how to proceed. There are a few options to consider:

Option 1: File a Complaint with Regulatory Authorities

If you have documented proof of harassment, you can file a complaint with the appropriate regulatory bodies. In the United States, this would be the Consumer Financial Protection Bureau (CFPB) or the Federal Trade Commission (FTC). In India, you may need to report the issue to the Reserve Bank of India (RBI) or the National Consumer Helpline.

These authorities can investigate the collector’s actions and may take corrective action. This could include issuing fines or sanctions against the collector, or they may help facilitate a resolution.

Option 2: Seek Legal Action

If the harassment continues, or if the debt collector has violated your rights under the Fair Debt Collection Practices Act (FDCPA), you can take legal action. A lawyer can help you file a lawsuit against the debt collector for damages caused by their unlawful practices. In some cases, you may be entitled to compensation for emotional distress or other losses.

Option 3: Reach Out to a Debt Mediation Service

If you prefer an alternative resolution without going to court, consider debt mediation. This service acts as a neutral party that helps you and the creditor reach a settlement. It can be an effective way to resolve disputes and stop harassment while avoiding lengthy legal processes.

Conclusion

We hope this blog has helped you understand the importance of documenting harassment and how you can build a strong case against unethical debt collectors. By following the right steps and gathering solid evidence, you can protect your rights and take action to stop harassment.

At Quicksettle, we’re committed to helping you manage your debt and achieve lasting financial freedom. With the right tools and knowledge, you can break free from the debt cycle and regain control of your financial well-being.

Frequently Asked Questions (FAQs)

Q1: How do I know if a debt collector is violating my rights?

Debt collectors violate your rights when they use threats, lies, excessive contact, or harassment. If they misrepresent the debt, contact third parties, or use abusive language, they’re violating the FDCPA.

Q2: Can I stop debt collectors from contacting me?

Yes, you can send a cease and desist letter requesting that the debt collector stop all communication. Once they receive it, they must comply, though they may still pursue legal action.

Q3: Can debt collectors contact my family or friends?

No, debt collectors cannot contact anyone other than you regarding your debt without your consent, unless they are attempting to locate you.

Q4: What if the debt collector threatens legal action or arrest?

If the debt collector threatens legal action or arrest without basis, this is a violation of the

FDCPA. Document the threat and report it to the authorities.

Q5: How can I file a complaint against a debt collector?

You can file a complaint with the CFPB, FTC, or RBI (in India). Provide documentation of the harassment to support your complaint.

Q6: What happens if I file a lawsuit against a debt collector?

If you file a lawsuit, the debt collector could be ordered to pay damages for the harassment. If they are found guilty, they may also face fines or sanctions.

Q7: Can I record phone calls with a debt collector?

In many areas, it is legal to record phone calls with a debt collector as long as you are part of the conversation. Check your local laws to make sure recording is permitted.

Comments